Vestrex

Maptek Data System

Maptek Compute Framework

Maptek Orchestration Environment

Join our early access program to unlock value for your organisation.

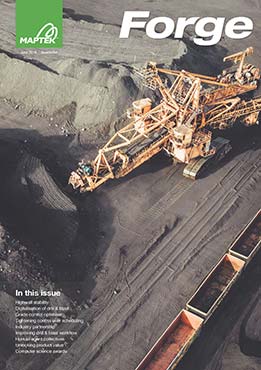

BlastLogic

Drill & blast management

Evolution

Interconnected mine scheduling

VisionV2X

Reliable proximity awareness underground

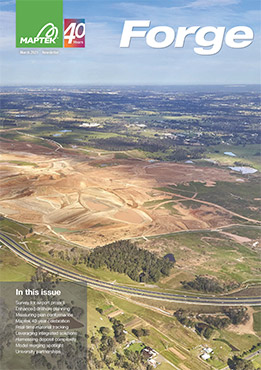

GeoSpatial Manager

Dynamic survey surface updates

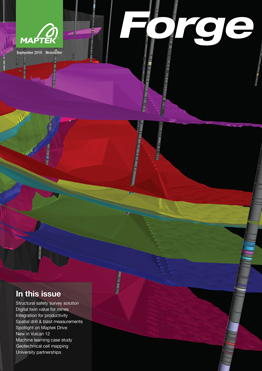

Vulcan

3D mine planning & geological modelling

GeologyCore

Streamlined geological modelling workflow

DomainMCF

Machine learning assisted domain modelling

Maptek Resource Tracking

Material tracking & reconciliation systems

Laser Scanners

3D laser scanning & imaging

PointStudio

Point cloud processing & analysis

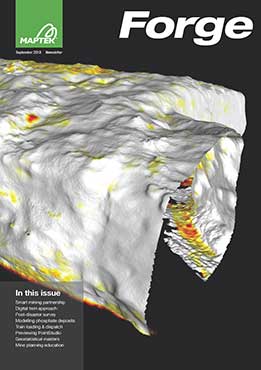

Sentry

LiDAR-based stability & convergence monitoring

PointModeller

Derive value from airborne or mobile sensor data